In today’s fast-paced digital world, banking and financial institutions are constantly looking for ways to streamline their operations, improve customer satisfaction, and bolster security. One of the most significant innovations in this realm has been the adoption of Interactive Voice Response (IVR) systems. IVR systems in India, are transforming the way customers interact with banks and financial institutions, ensuring seamless experiences and heightened security measures.

In this blog, we will explore the role of IVR in the banking and financial sector, focusing on how these systems enhance customer experience and security. We will also discuss how IVR solutions, especially those provided by reliable IVR service providers, are helping to reshape the landscape of customer service in the industry.

Before diving into its specific benefits, it’s essential to understand what an IVR system is. An IVR system is an automated telephony technology that interacts with callers, gathers information, and routes calls to the appropriate department or representative. Through a series of pre-recorded voice prompts or touch-tone keypad selections, customers can access information or perform specific transactions without needing to speak directly to a human agent.

IVR systems are typically used in customer service operations across various industries, including banking and finance. In India, the adoption of IVR technology has been particularly prominent, given the country’s large and diverse customer base.

India, with its growing banking infrastructure, evolving financial sector, and the large scale of mobile and internet penetration, has become a significant market for IVR solutions. The banking and financial sectors are experiencing rapid growth, and to meet customer expectations, these organizations need to offer round-the-clock services, faster responses, and secure transactions.

As banking services move increasingly online, many customers prefer self-service options. An IVR system in India addresses this demand efficiently, providing customers with 24/7 access to banking services. Whether it’s checking account balances, making fund transfers, or getting information about loan rates, customers can use the IVR to perform routine banking tasks without waiting in long queues or depending on human representatives. This not only enhances the overall customer experience but also alleviates pressure on call centers and customer service representatives.

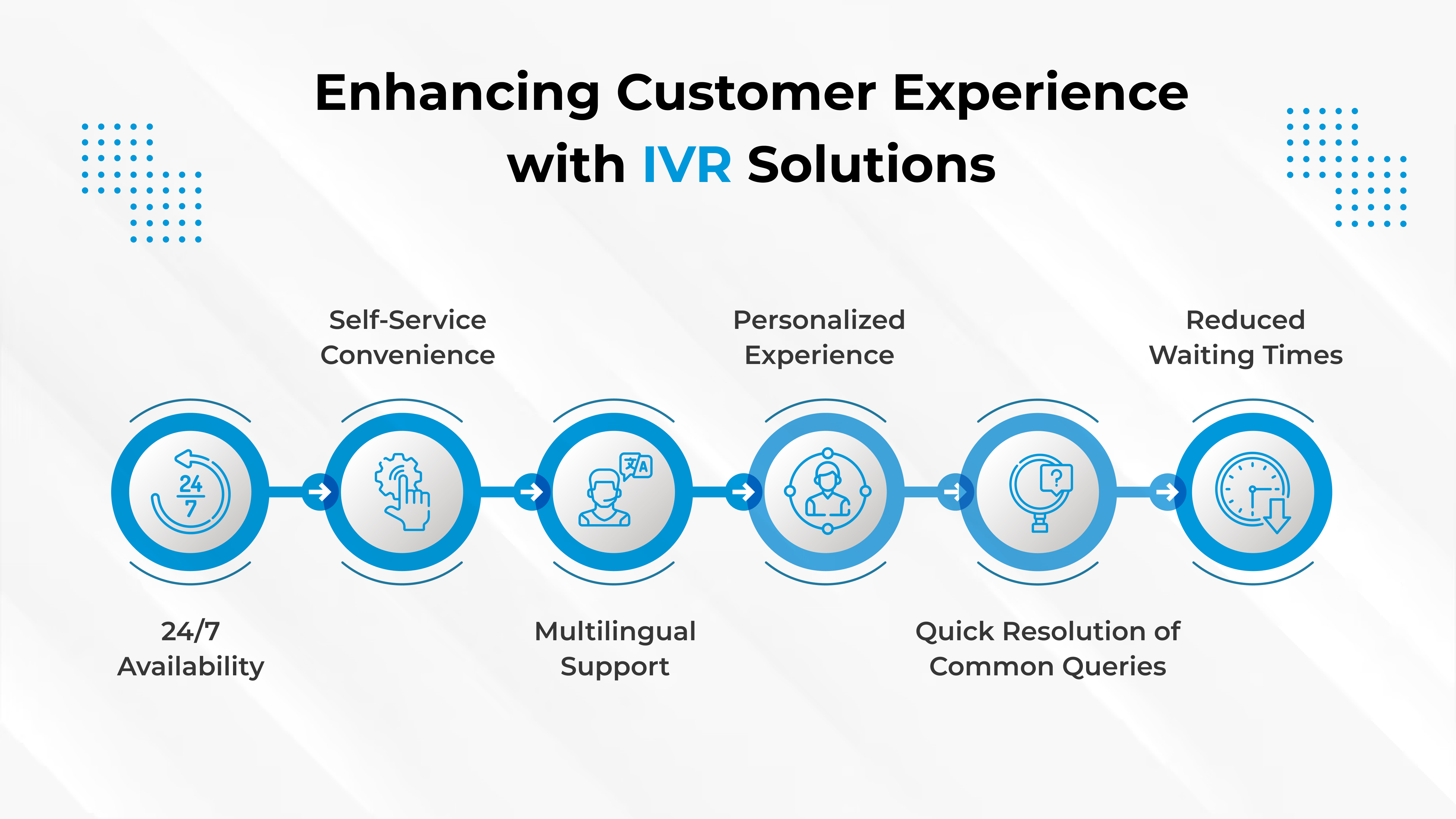

Customer experience is at the heart of every successful business, especially in industries like banking and finance. The use of IVR systems in banking allows financial institutions to offer a range of services that make banking simpler and more convenient for customers. Here’s how IVR solutions enhance the customer experience:

Banks and financial institutions are required to serve customers at all hours of the day. The traditional model of customer service, relying on human agents, is not feasible to maintain around-the-clock operations. IVR systems bridge this gap by providing 24/7 availability to customers. Whether it’s 2 PM or 2 AM, customers can check their account balances, request mini-statements, make fund transfers, or inquire about loan details without any delay.

Modern consumers, especially millennials and Gen Z, are highly inclined toward self-service solutions. They prefer to resolve issues and perform tasks independently rather than waiting for an agent’s assistance. IVR systems allow customers to complete a variety of banking tasks without speaking to a human, thus saving time and providing the convenience of self-service.

For example, customers can use an IVR system to check account balances, review recent transactions, pay bills, and transfer money between accounts. The process is quick, efficient, and available at all times.

India is a linguistically diverse country with multiple languages spoken across different regions. An IVR system in India can be programmed to offer multilingual support, allowing customers to interact in their preferred language. This feature is crucial for making banking services more inclusive and accessible to all, regardless of their language preference.

By supporting a variety of languages, IVR systems ensure that customers feel comfortable and confident while interacting with the bank’s services, further enhancing the overall customer experience.

Modern IVR systems have the capability to offer personalized interactions based on the customer’s profile. When a customer calls, the system can recognize the phone number or account details and provide tailored services or prompts. For instance, the IVR system can greet the customer by name, offer personalized account information, or even provide customized loan or credit card offers based on past interactions.

This level of personalization builds a stronger relationship between customers and financial institutions, making customers feel valued and understood.

IVR systems excel at handling common customer queries such as checking balances, recent transactions, and finding branch locations. By automating responses to frequently asked questions, customers can get immediate answers without having to wait for an agent. This not only reduces wait times but also enhances the overall efficiency of the call center operations.

For instance, customers looking to know the current interest rates or exchange rates can do so instantly, without the need for a representative. This saves valuable time for both customers and banks.

One of the most significant pain points in traditional customer service systems is long wait times. Callers often find themselves on hold for extended periods, which can lead to frustration. With an IVR system, most customers can be directed to the right department or receive the information they need without waiting for a human agent. This reduction in wait times leads to a better customer experience and increases customer satisfaction levels.

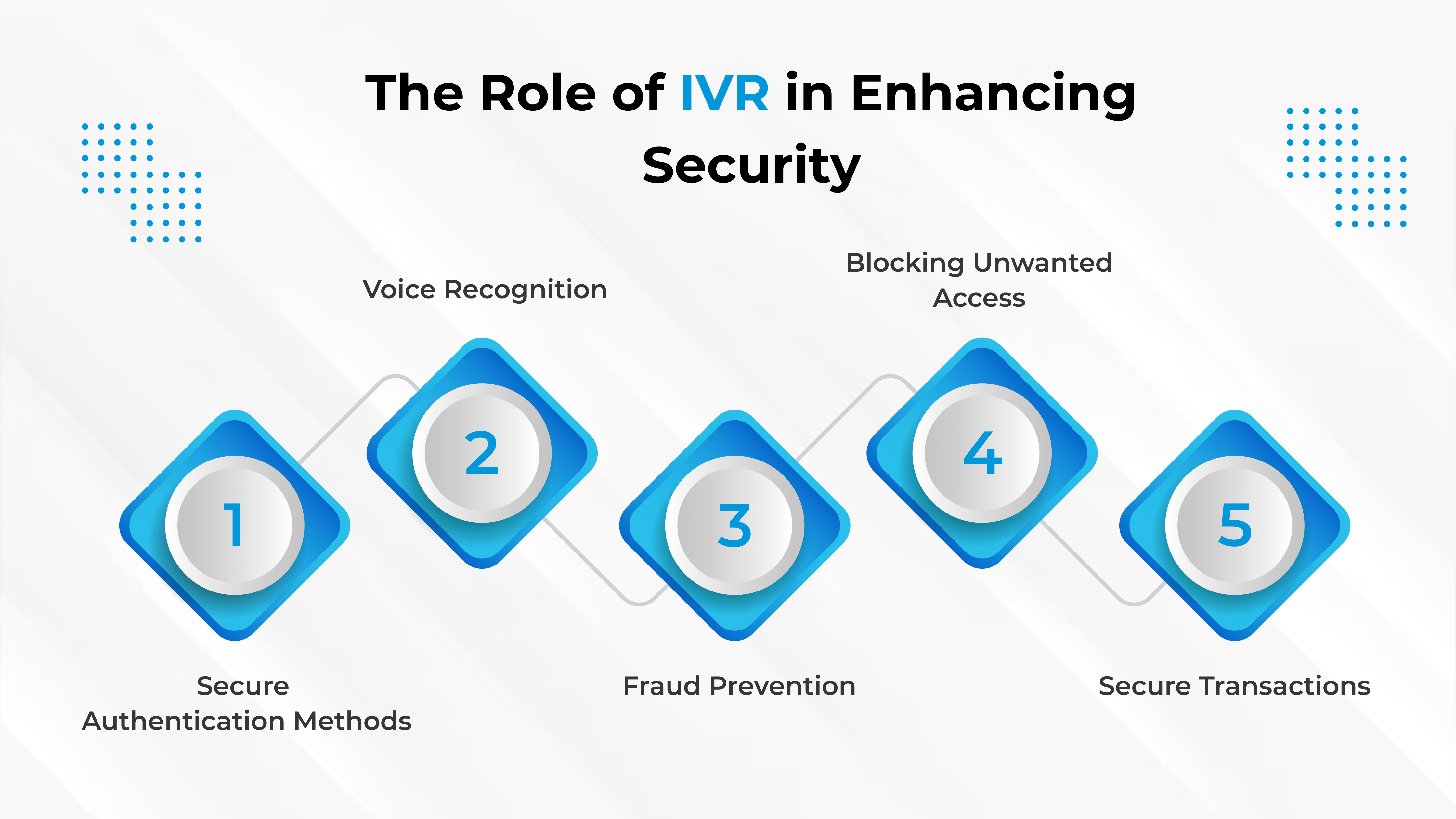

Security is a top priority for any financial institution. Banks and financial institutions handle sensitive customer data, and any breach can have serious consequences. IVR systems play a critical role in safeguarding this data and ensuring that only authorized users can access specific services. Here’s how IVR solutions enhance security:

IVR systems can integrate multiple layers of authentication to ensure that customers are who they say they are. One of the most common security features used in IVR systems is multi-factor authentication (MFA), which requires customers to provide more than one form of verification before completing a transaction.

For example, in India, an IVR system may first ask for the customer’s account number or mobile number, followed by a one-time password (OTP) sent to their registered phone number. This ensures that even if someone knows the customer’s account details, they won’t be able to access sensitive information or initiate transactions without the OTP.

Voice biometrics, which use a customer’s unique voice pattern for authentication, is gaining traction in the banking sector. An IVR system with voice recognition can verify the caller’s identity based on their voice, much like how a fingerprint or retina scan works. This biometric approach adds an additional layer of security, especially in preventing fraud.

Fraudulent activities, including identity theft and unauthorized access to accounts, are a significant concern for banks and financial institutions. IVR systems can help detect potential fraud by monitoring patterns of usage and flagging suspicious activity. For instance, if a customer suddenly requests a large sum transfer from an unusual location, the system can trigger additional verification steps or alert the bank’s fraud detection team.

An IVR system can also block access to specific services or accounts after multiple failed authentication attempts. This mechanism prevents unauthorized users from trying to access the account and acts as an additional deterrent against fraud.

IVR systems ensure that sensitive financial transactions, such as money transfers and bill payments, are conducted securely. For example, before a large money transfer is initiated, the system can require a voice print or an OTP for added security, minimizing the chances of unauthorized access.

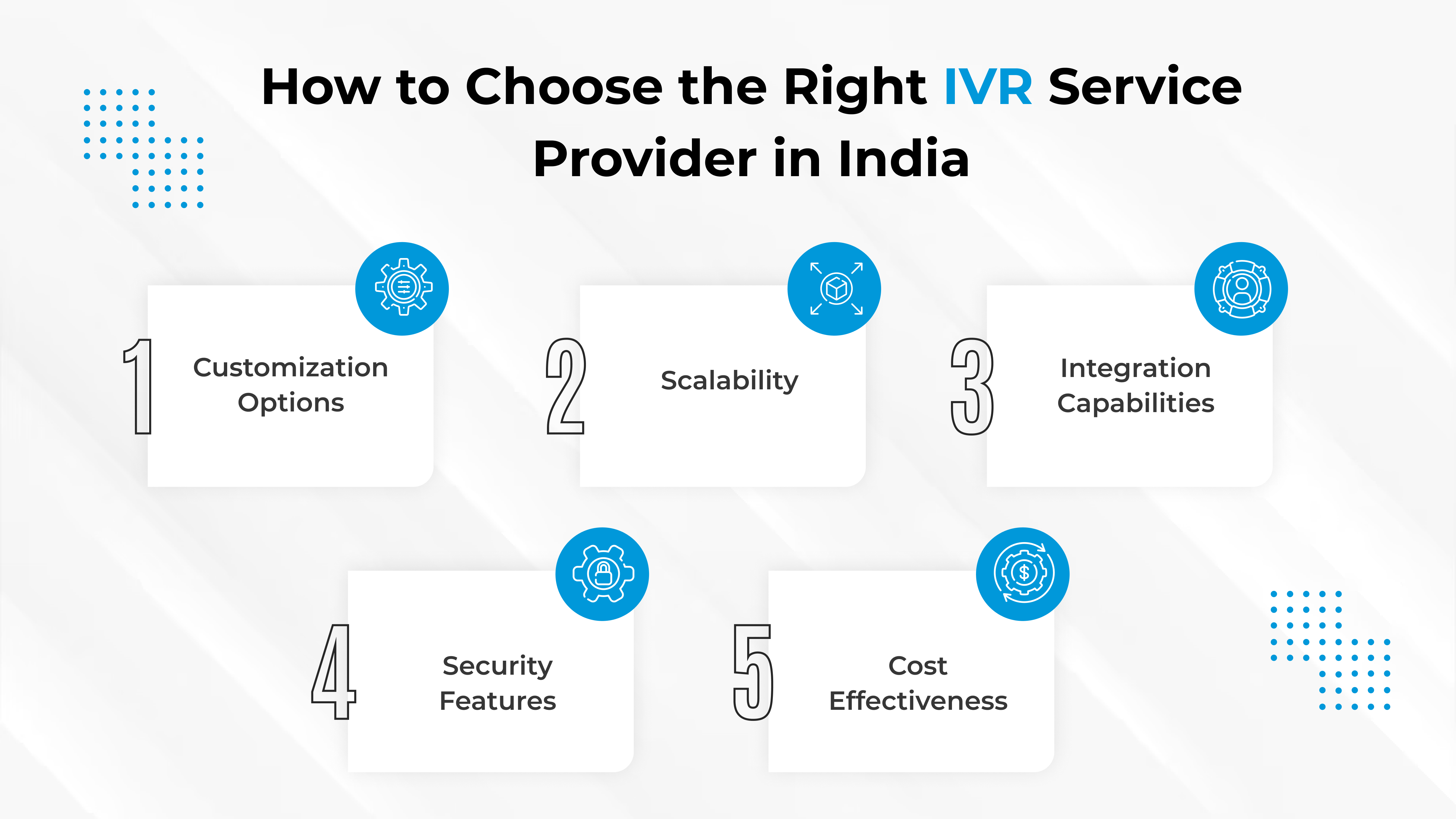

Choosing the right IVR service provider in India is crucial for banks and financial institutions that want to maximize the benefits of IVR systems. When selecting an IVR service provider, financial institutions should consider the following factors:

Banks need an IVR solution that can be tailored to meet their specific needs. A good IVR service provider should offer customizable features, such as multi-language support, personalized interactions, and the ability to handle complex banking transactions.

As banks grow and customer bases expand, their IVR systems need to scale to accommodate increased demand. A reliable IVR service provider should offer scalable solutions that can grow alongside the organization’s needs without compromising performance.

An IVR system should seamlessly integrate with the bank’s existing CRM, core banking system, and other technological infrastructure. This ensures that customer data is accurately synchronized, making for a more efficient and streamlined service.

A reliable IVR service provider like Kommuno should prioritize security. Look for providers that offer robust authentication mechanisms like multi-factor authentication and voice biometrics. Additionally, the provider should comply with industry security standards and regulations.

Banks and financial institutions must ensure that the IVR solution provides value for money. A good provider should offer a balance between cost and the quality of services offered, ensuring that the IVR system delivers the expected benefits while staying within budget.

The IVR system in India is playing an instrumental role in transforming the way customers interact with their banks and financial institutions. From offering 24/7 self-service capabilities to enhancing security with robust authentication methods, IVR systems have become a vital tool for improving both customer experience and security.

By adopting cutting-edge IVR solutions, banks can offer a seamless, personalized, and secure experience that meets the evolving expectations of today’s customers. With the right IVR service provider like Kommuno, financial institutions can not only streamline their operations but also build stronger relationships with customers, fostering loyalty and trust in the process.

As the banking sector continues to embrace digital transformation, the role of IVR technology will only become more critical in shaping the future of customer service and security. With the increased adoption of advanced technologies like voice biometrics, fraud detection, and multilingual support, IVR systems are poised to remain a cornerstone of banking operations in India.

Elevate Your Business Game with Kommuno – The best way to stay connected to customers!

Copyright ©2024 All Rights Reserved | Kommuno Technologies Pvt Ltd

Copyright ©2024 All Rights Reserved | Kommuno Technologies Pvt Ltd